Mahama Delivers Tax Relief: No More E-Levy, Betting Tax, and COVID Levy

Mahama abolishes E-Levy, betting tax, and COVID-19 levy in Ghana 2025 budget"

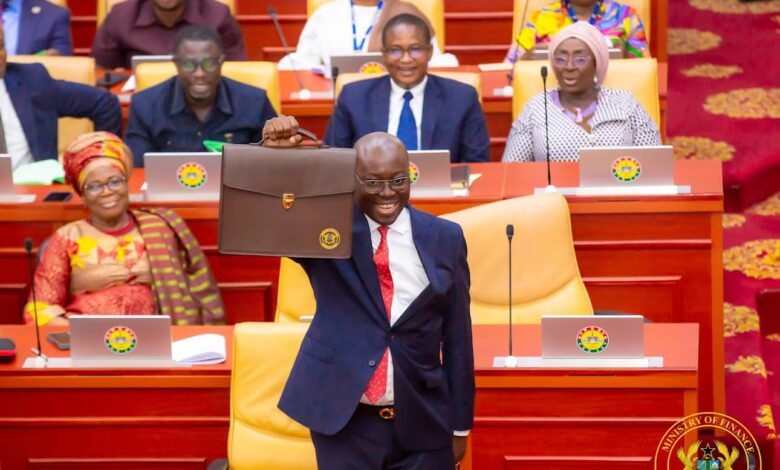

President John Mahama’s administration has officially abolished several controversial taxes, including the Electronic Transactions Levy (E-Levy), the 10% betting tax, the COVID-19 levy, and the emissions levy. This move, announced in the 2025 Budget Statement by Finance Minister Dr. Cassiel Ato Forson, aims to reduce the financial burden on Ghanaians and support economic recovery,

In a bold move to ease the economic pressure on Ghanaians, President John Mahama’s administration has scrapped the E-Levy, betting tax, COVID-19 levy, and emissions levy as part of its 2025 budget reforms. The E-Levy, which had been widely criticized for burdening small businesses and low-income earners, is now a thing of the past. Similarly, the betting tax, which many young people saw as a financial obstacle in an already tough job market, has been removed

Finance Minister Dr. Cassiel Ato Forson announced this major policy shift while presenting the 2025 Budget Statement. He emphasized that these changes align with the government’s commitment to economic growth, business expansion, and job creation instead of relying on excessive taxation

Ghanaians React with Excitement, Citizens and business owners have welcomed the decision, praising the government for listening to their concerns. Many believe that eliminating these taxes will boost economic activity, increase disposable income, and stimulate local businesses

.

With this tax relief in place, the Mahama administration has taken a decisive step toward rebuilding confidence in the economy and making life easier for the average Ghanaian. Do you think this move will improve Ghana’s economy? Share your thoughts below! and let see how you think about this decision government has taken.